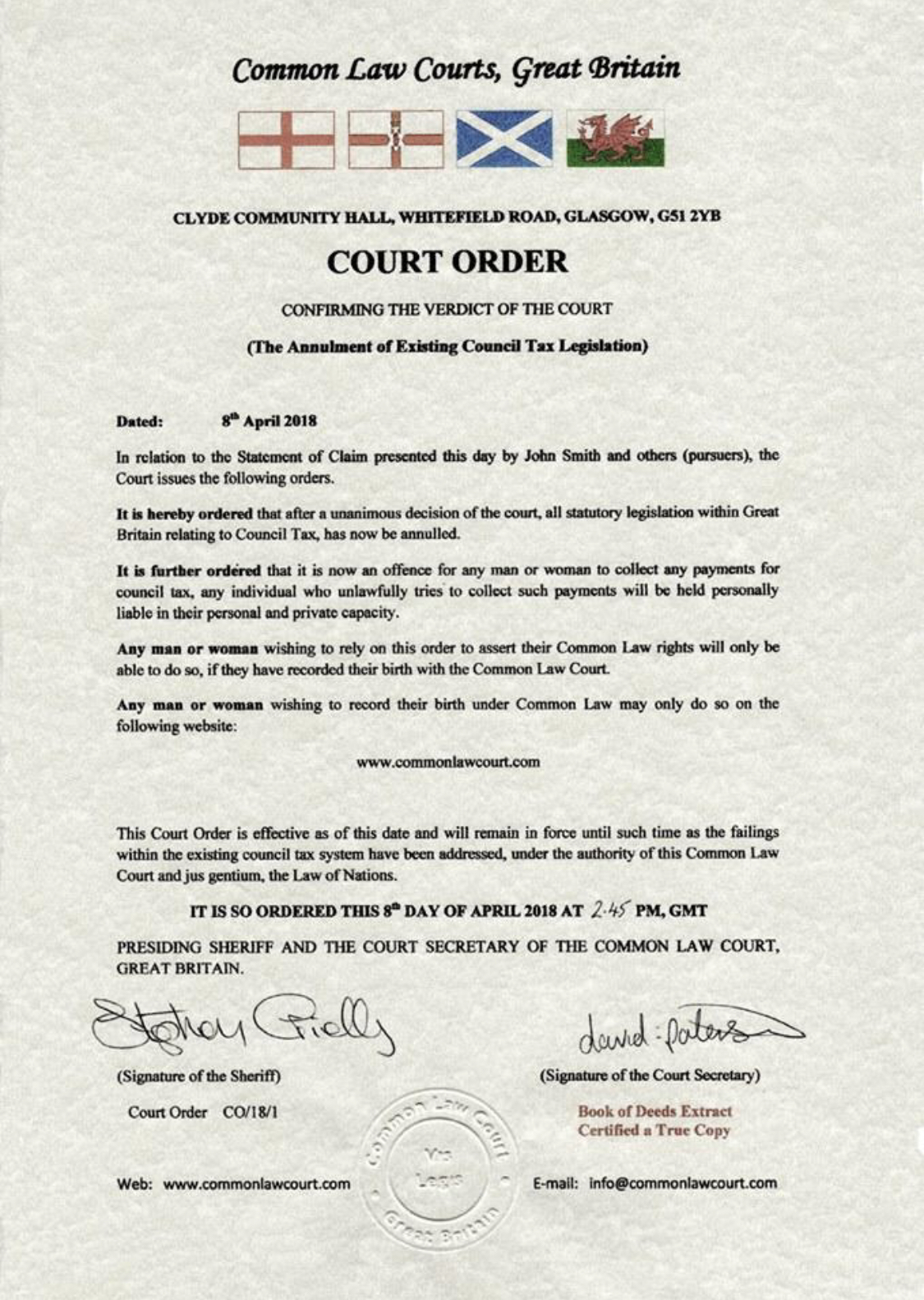

The Common-law court made an order regarding Council Tax (CT) legislation which has been annulled since April 2017 to collect any payments of CT and the order further declared the collection of CT an offence for ANY individual to unlawfully make any attempt to collect and will be deemed liable for damages in both public and private capacity.

The following Common Law crimes were also highlighted:

-

Personation

- Fraud which is committed by impersonating another, or by falsely assuming a certain position of status, in order to obtain or gain benefit or advantage, namely diminishing the capacity of a man or woman to a fiction with no life, which is known as a person, a crown construct.

-

Criminal Subrogation

- Where a man or woman has been substituted for a legal fiction, with no life, this is used to defraud and gain benefit, and to defraud a man or woman of their rights and property, unlawfully.

In conclusion it was pointed out that the issue of Council Tax was marred with prejudice and bias from the beginning because of the collusion and fraud which has been committed by members of a statutory system that protects vested interests. The issue is not whether taxes should be paid, it is the fraudulent behaviour of the authorities and the failure to hold these individuals accountable for abusing their positions that needs to be addressed.

We no longer consent to paying criminals in public office or aiding/abetting crimes against the people. When we hit +20,000 subscribers, we will COORDINATE MASS ACTION.